In today’s increasingly competitive digital landscape, understanding and predicting Lifetime Value (LTV) is paramount for businesses seeking sustainable growth. This article delves into the critical role of LTV prediction in shaping effective user acquisition strategies and maximizing Return on Investment (ROI). Across various industries, from e-commerce to SaaS, the ability to accurately forecast the total revenue a customer is expected to generate throughout their relationship with a business provides a significant competitive advantage. By leveraging sophisticated analytical techniques and readily available data, companies can optimize their marketing spend, personalize customer experiences, and ultimately drive profitability.

Specifically, this exploration of LTV prediction will cover various methodologies for estimating future customer value, including cohort analysis, regression models, and machine learning algorithms. We will discuss how these predictive models can be integrated into user acquisition workflows, allowing for more targeted and efficient campaigns. Furthermore, we will examine real-world examples of businesses that have successfully implemented LTV-driven strategies, showcasing the tangible benefits of this approach. Ultimately, this article aims to provide a comprehensive guide for businesses of all sizes to harness the power of LTV to enhance their user acquisition efforts and achieve a greater ROI.

What is Lifetime Value (LTV) and Why Does It Matter?

Lifetime Value (LTV) represents the predicted revenue a customer will generate for your business during their entire relationship with your company. It’s a crucial metric for understanding the long-term profitability of your customer base.

Why does LTV matter? Because it shifts the focus from short-term gains to sustainable growth. Understanding LTV allows businesses to make informed decisions about:

- Customer Acquisition Cost (CAC): Knowing the potential LTV helps determine how much you can afford to spend acquiring a new customer.

- Marketing Strategies: LTV insights inform which marketing channels and campaigns yield the most valuable customers.

- Customer Retention: Identifying high-LTV customers enables businesses to prioritize retention efforts and maximize their value.

- Resource Allocation: It guides investment in areas that drive long-term customer loyalty and profitability.

In essence, LTV provides a roadmap for optimizing customer relationships and achieving sustainable business success.

The Importance of LTV Prediction for User Acquisition

Understanding the potential lifetime value (LTV) of a user before acquiring them is crucial for effective user acquisition strategies. LTV prediction allows businesses to make informed decisions about how much to invest in acquiring different types of customers.

By accurately predicting LTV, companies can:

- Optimize ad spend: Allocate resources to channels and campaigns that attract high-LTV users.

- Improve targeting: Focus on acquiring users with characteristics that correlate with higher lifetime value.

- Increase ROI: Maximize the return on investment for user acquisition efforts by prioritizing valuable customers.

Without LTV prediction, user acquisition can become a costly guessing game. Investing in understanding and predicting LTV ensures that marketing budgets are used efficiently and effectively, leading to sustainable growth.

Key Data Points Used in LTV Prediction Models

Accurate LTV prediction relies on a comprehensive understanding of user behavior and characteristics. Identifying the right data points is crucial for building effective prediction models. These data points can be broadly categorized into:

- Acquisition Data: Source, campaign, and cost of acquisition provide insight into user quality and potential ROI.

- Engagement Data: Frequency of app/website visits, time spent, features used, and content consumed reflect user interest and stickiness.

- Monetary Data: Purchase history, average order value, subscription details, and transaction frequency directly correlate with revenue generation.

- Demographic & User Profile Data: Age, gender, location, and other profile information help segment users and identify patterns.

- Customer Support Data: Interactions with customer support, satisfaction scores, and issue resolution times can indicate potential churn.

The relative importance of each data point can vary depending on the specific business and industry. A thorough analysis of historical data is essential to determine which factors are most predictive of future customer value.

Different Approaches to LTV Prediction: Statistical vs. Machine Learning

Predicting Lifetime Value (LTV) involves employing various methodologies, primarily falling under two categories: statistical modeling and machine learning.

Statistical models, such as cohort analysis and regression, rely on historical data and predefined formulas to estimate future customer value. These methods are generally simpler to implement and interpret, but might struggle with complex, non-linear relationships.

Conversely, machine learning models, including neural networks and random forests, can automatically learn complex patterns from data, often leading to more accurate predictions, especially when dealing with large datasets and numerous variables. However, they demand more computational resources and expertise, and their “black box” nature can make interpretation challenging.

The choice between these approaches depends on data availability, the complexity of the customer behavior, and the resources available for model development and maintenance.

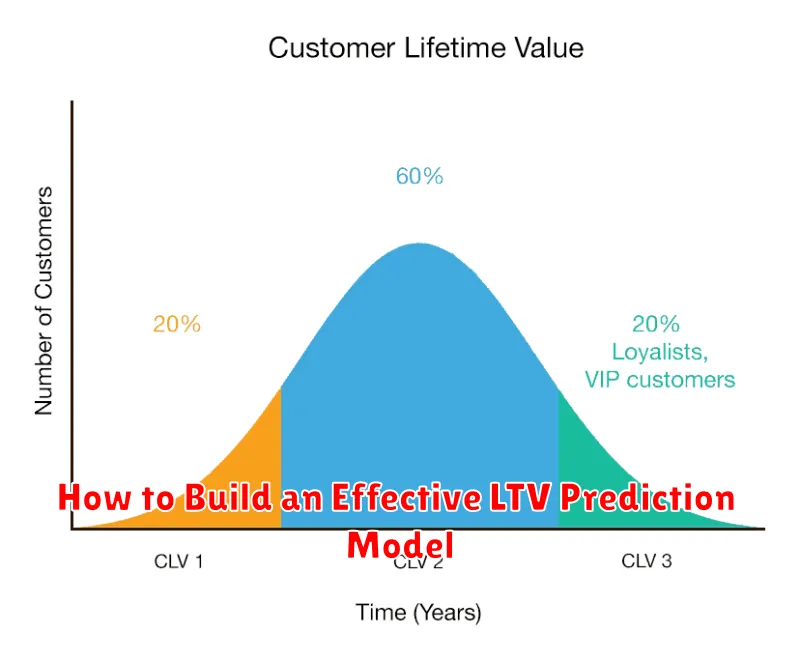

How to Build an Effective LTV Prediction Model

Constructing a robust Lifetime Value (LTV) prediction model requires a structured approach. First, clearly define the prediction horizon (e.g., 12 months, 24 months). Next, gather comprehensive historical data, ensuring data quality and completeness.

Select appropriate modeling techniques. Statistical methods like cohort analysis and regression are suitable for simpler scenarios. For more complex scenarios, machine learning models such as regression trees, neural networks, or survival analysis models often provide better accuracy. Feature engineering plays a crucial role; consider recency, frequency, monetary value (RFM) metrics, demographic data, and behavioral indicators.

The model building process includes training, validation, and testing. Split your data into training and validation sets. Use the training set to train the model and the validation set to fine-tune the parameters and evaluate performance. Common evaluation metrics include Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and R-squared. Continuously monitor and retrain the model as new data becomes available to maintain accuracy and relevance.

Using LTV Prediction to Optimize User Acquisition Campaigns

Lifetime Value (LTV) prediction is a powerful tool for optimizing user acquisition campaigns. By understanding the predicted value of different user segments, businesses can make more informed decisions about their marketing spend.

Here’s how LTV prediction can be used to enhance user acquisition:

- Targeting High-Value Users: LTV prediction allows you to identify and target user segments with the highest potential LTV, maximizing ROI.

- Optimizing Bidding Strategies: Adjust your bidding strategies based on predicted LTV. Bid higher for users with a higher predicted value and lower for those with a lower predicted value.

- Personalizing Acquisition Efforts: Tailor your marketing messages and offers to specific user segments based on their predicted LTV, increasing conversion rates.

- Allocating Budget Effectively: Allocate your marketing budget to the channels and campaigns that are most likely to acquire high-value users, improving overall marketing efficiency.

By integrating LTV prediction into your user acquisition strategy, you can acquire more valuable customers and improve the overall profitability of your marketing efforts.

The Role of Segmentation in Improving LTV Prediction Accuracy

Segmentation plays a crucial role in enhancing the accuracy of Lifetime Value (LTV) prediction. By dividing customers into distinct groups based on shared characteristics, businesses can develop more refined and targeted LTV models.

Rather than applying a one-size-fits-all approach, segmentation allows for the identification of unique behaviors and spending patterns within each group. This granular view enables more precise forecasts of future revenue generation.

Common segmentation criteria include:

- Demographics (age, gender, location)

- Acquisition channel

- Purchase history

- Engagement metrics (website visits, app usage)

For example, customers acquired through social media advertising may exhibit different LTV characteristics compared to those acquired through organic search. By building separate LTV prediction models for each segment, organizations can achieve a more accurate understanding of the true value of their customer base and optimize their user acquisition efforts accordingly.

Challenges and Considerations in LTV Prediction

Predicting Lifetime Value (LTV) is not without its hurdles. Several challenges and considerations must be addressed to ensure the accuracy and reliability of the predictions.

One significant challenge is data quality. Inaccurate, incomplete, or inconsistent data can severely impact the model’s performance. Ensuring data is clean and reliable is crucial. Another consideration is the time horizon. Predicting LTV over an extended period can be increasingly difficult due to evolving market conditions and shifting consumer behavior. Choosing an appropriate time frame for prediction is essential.

Furthermore, model complexity presents a trade-off. While more complex models might capture intricate patterns, they are also prone to overfitting, leading to poor generalization on unseen data. Selecting the right level of complexity is a key consideration. Finally, external factors, such as economic downturns or competitor actions, can significantly influence customer behavior and LTV, making accurate prediction more challenging.

- Data Quality & Availability

- Model Complexity vs. Accuracy

- Dynamic Market Conditions

- Attribution Challenges

Measuring the ROI of LTV-Driven User Acquisition Strategies

Determining the return on investment (ROI) of LTV-driven user acquisition strategies is critical for validating their effectiveness and justifying resource allocation. The fundamental principle involves comparing the cost of acquisition (CAC) against the predicted lifetime value (LTV) of acquired users.

Calculating ROI

The ROI can be calculated using the following formula:

ROI = ((LTV – CAC) / CAC) * 100

A positive ROI signifies that the LTV exceeds the CAC, indicating a profitable user acquisition strategy. Conversely, a negative ROI suggests that the cost of acquiring users is higher than the revenue they generate over their lifetime, necessitating adjustments to the acquisition strategy or LTV prediction model.

Key Metrics to Monitor

Several metrics should be monitored to accurately assess the ROI, including:

- Cost Per Acquisition (CPA): The cost of acquiring a single user.

- Customer Lifetime Value (LTV): The predicted revenue a user will generate over their lifetime.

- Conversion Rates: The percentage of users who complete a desired action.

- Retention Rate: The percentage of users who remain active over a specific period.

Future Trends in LTV Prediction and User Acquisition

The landscape of LTV prediction and user acquisition is constantly evolving, driven by advancements in technology and changes in consumer behavior. Several key trends are shaping the future of this field.

Increased Use of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) algorithms are becoming increasingly sophisticated, enabling more accurate and granular LTV predictions. Expect to see wider adoption of deep learning techniques and automated feature engineering to improve model performance.

Emphasis on Privacy-Preserving Techniques

With growing concerns around data privacy, there is a rising demand for LTV prediction methods that respect user privacy. Federated learning and differential privacy are gaining traction as approaches that allow for model training without directly accessing sensitive user data.

Integration with Customer Data Platforms (CDPs)

The seamless integration of LTV prediction models with Customer Data Platforms (CDPs) will enable marketers to access real-time LTV insights and personalize user acquisition campaigns with greater precision.

Focus on Real-Time LTV Prediction

The ability to predict LTV in real-time or near real-time is becoming increasingly important. This enables dynamic bidding strategies and personalized onboarding experiences that maximize the potential value of each new user.